defer capital gains tax uk

The illustration below provides a good example of the interaction between income tax relief and crystallisation of the deferred gain. Capital gains tax CGT is levied on capital gains made on the disposal including gifts of most assets.

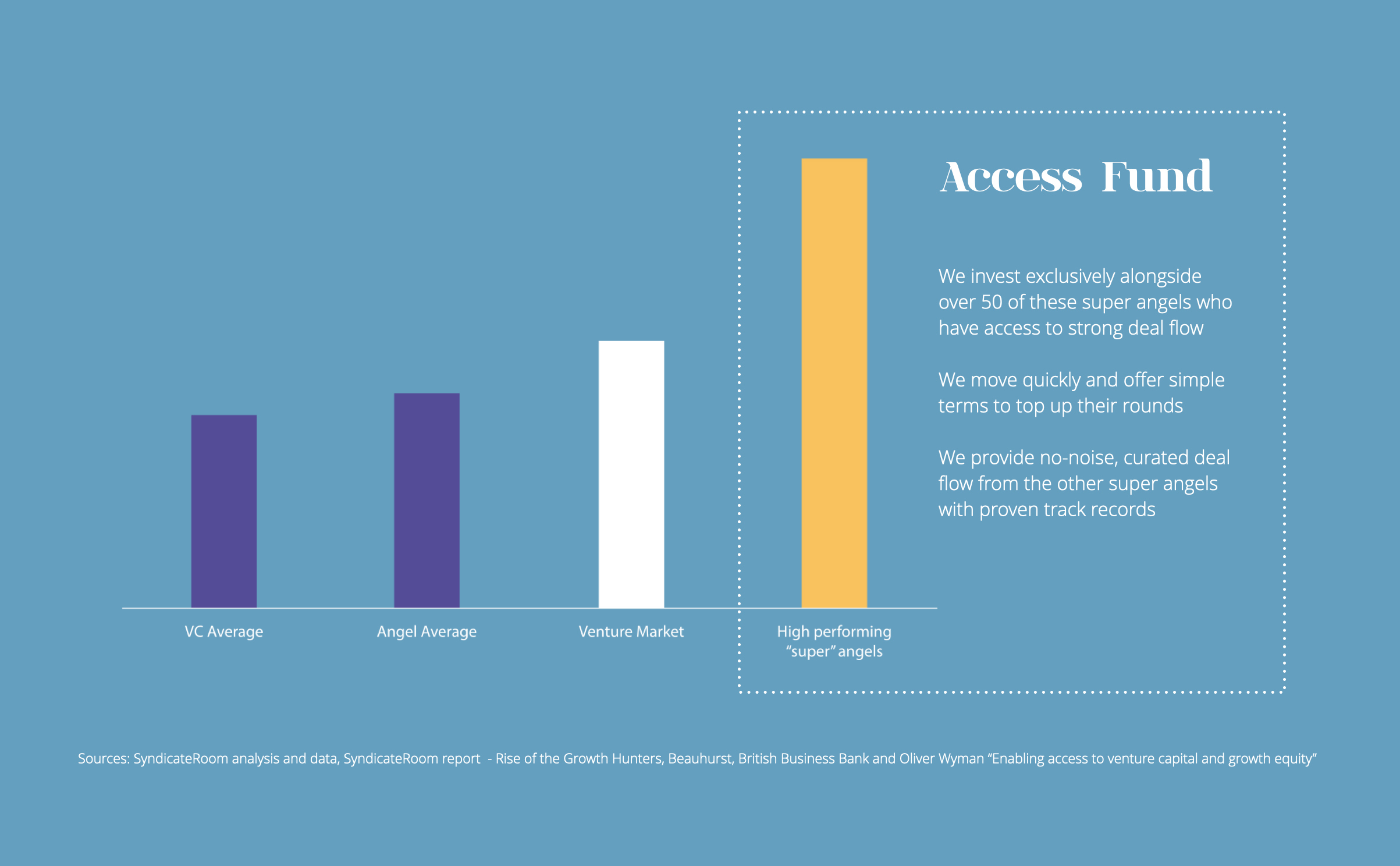

Is Your Alpha Big Enough To Cover Its Taxes A 25 Year Retrospective Research Affiliates

This will only apply where the amount of the proceeds is less than 20 of the.

. CG14850 - Deferred consideration. See the Introduction to capital gains tax guidance note. The gain is deferred until December 31 2026or to the year when the.

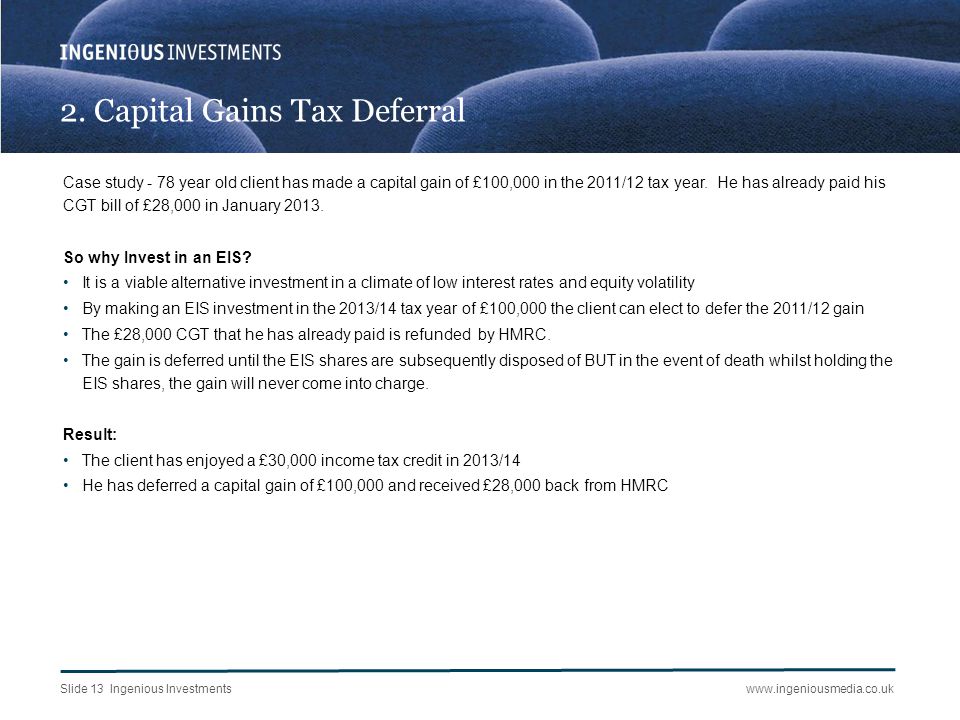

Its important to keep in mind though that a 1031. However if the disposal is of business assets by a trader including a. 100000 Capital Gain Invested via EIS.

You subscribe 600000 for EIS shares issued by a trading company in June 2008. It explains the capital gains aspects of the Enterprise Investment Scheme EIS. Under current law short-term capital gains are treated as ordinary income with a top tax rate of 408 370 plus 38 net investment income tax NIIT.

This is the advantage of the deferred sales trust. Capital gains tax CGT is levied on capital gains made on disposals including gifts of most assets eg. Deferring the property gain individuals.

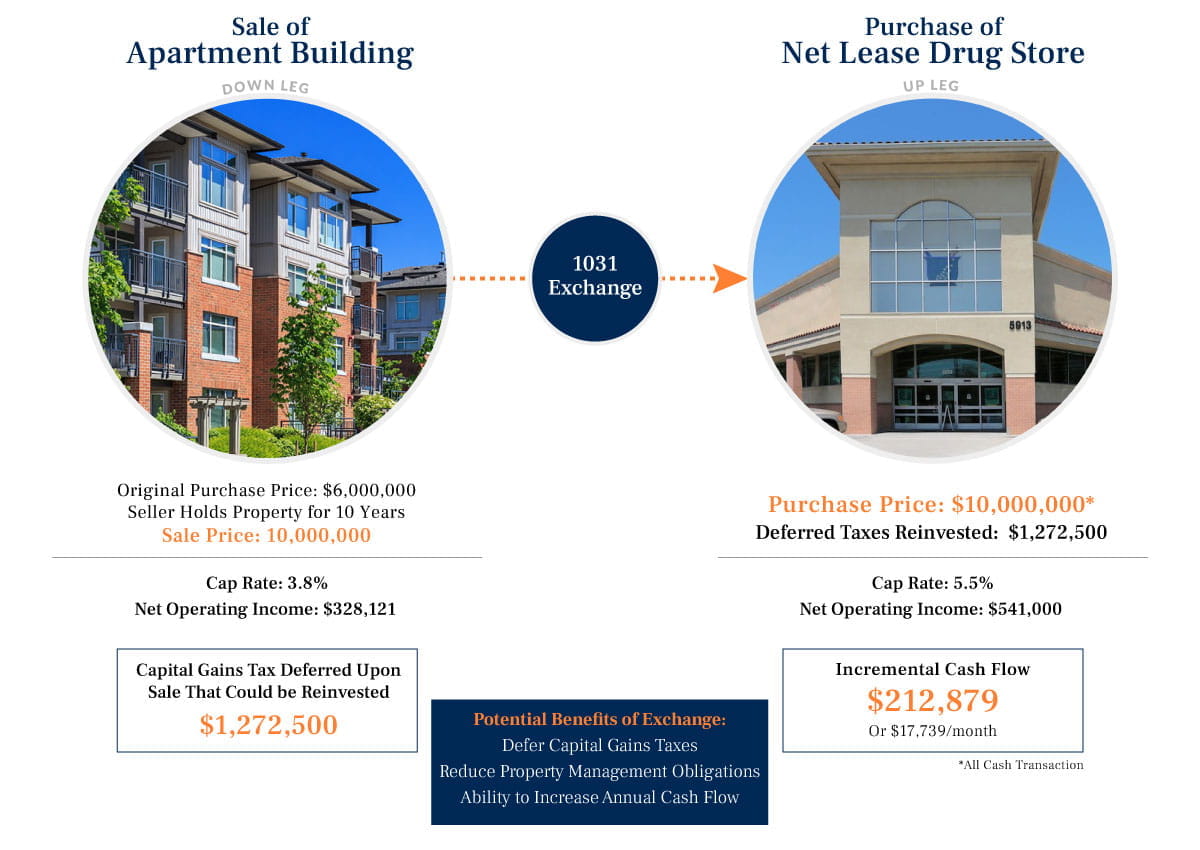

This guide is for investors. For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain. A 1031 exchange allows you to defer capital gains tax thus freeing more capital for investment in the replacement property.

You receive the maximum Income Tax relief 100000. Use the IRS Primary Residence Exclusion If Applicable While not specifically related to the sale of a commercial property IRS rules allow taxpayers to reduce. Antiques by individuals at two rates namely 18.

For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below. There are various capital gains tax reliefs which an individual can utilise to defer the capital gain on a property disposal until a. Depending on the nature of the asset disposed of this can result in the individual paying capital gains tax CGT at 20 or.

However theyll pay 15 percent on capital gains if their. This guidance covers the tax treatment of disposals where some or all of the proceeds are not received immediately. Ways to Potentially Defer Capital Gains Tax on Stocks 2 weeks ago Oct 29 2021 This means only capital gains from the sale of real estate for investment or business purposes are eligible.

This includes venture capital schemes disposal relief and deferral. Because the DST is recognized as an installment sale by IRS Section 453 the capital gains tax can be legally deferred. Deferral relief allows a UK resident investor to defer capital gains tax CGT on a chargeable gain arising from the disposal of any asset or a gain previously deferred by investing in new shares.

If there is a disposal of only a small part of a piece of land you may be able to claim a form of deferral relief.

Taxation In The United Kingdom Wikipedia

Capital Gains Tax On Uk Property How To Report To Hmrc Maynard Johns

1031 Exchange Investment Properties Marcus Millichap

Doing Business In The United States Federal Tax Issues Pwc

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

How To Know If You Have To Pay Capital Gains Tax Experian

Question For Uk Residents Just To Check I Understand This Right Crypto Counts As Capital Gains So As Long As I Make Less Than The Allowance Value Of 12 300 My Crypto

Selling Stock How Capital Gains Are Taxed The Motley Fool

Is Your Alpha Big Enough To Cover Its Taxes A 25 Year Retrospective Research Affiliates

Deferring Capital Gains Tax Cgt With Eis

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

6 Ways To Minimise Cgt On Cryptocurrency Uk Cryptocurrency Accountant And Tax Advisers Cryptocurrency Tax Specialist

An Overview Of Capital Gains Taxes Tax Foundation

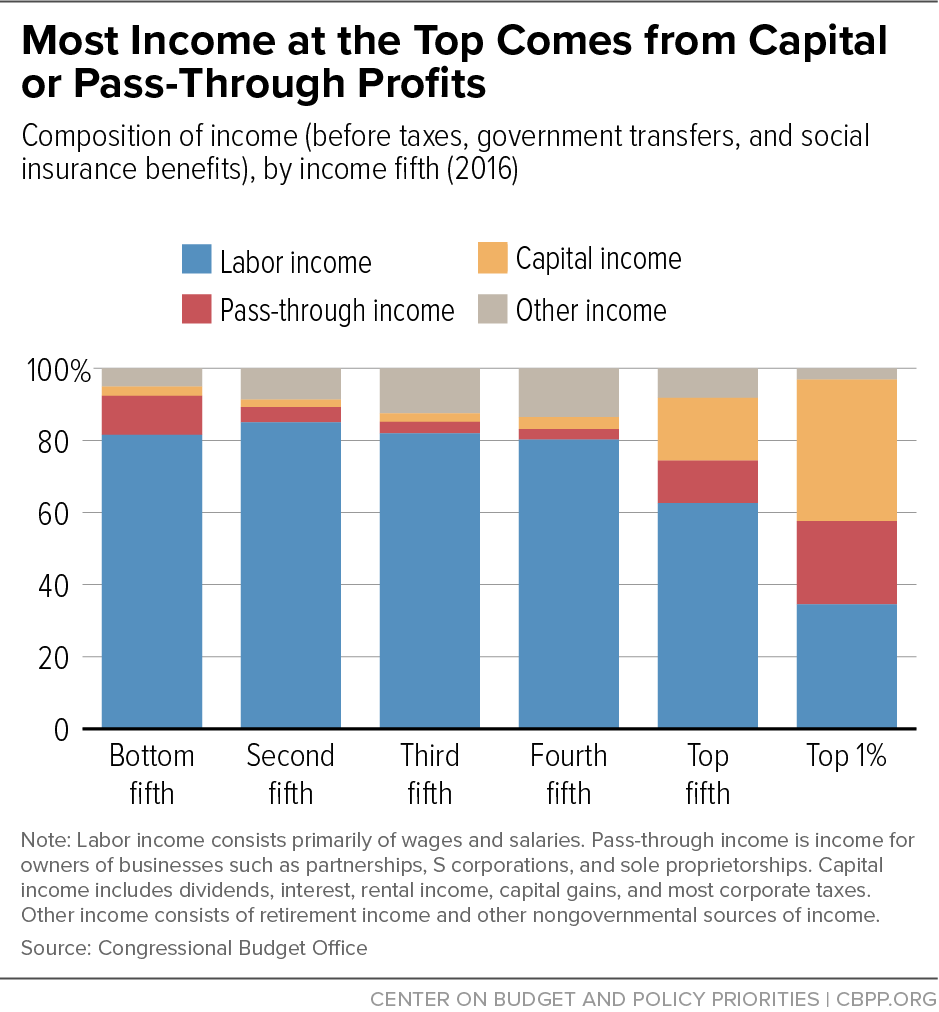

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Opportunity Zones In 2022 A Tax Financial Analysis Cla Cliftonlarsonallen

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Defer Capital Gains To Take Advantage Of The Lower Tax Rates Bsfp

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep